Supporting Graduates of the Pandemic

w/Robert Farrington

Use the buttons above to listen now.

Transcript - Supporting Graduates of the Pandemic

Rich: On this episode of team building saves the world. These kids have been really struggling in ways nobody has had to beforehand.

Robert: I mean, or even like a virtual internship, like what is that? Lawyers are frustrated, but these gen Z years are frustrated. They’re not learning the job. They’re not getting the experiences that they’re looking for.

Rich: All right. So we have just depressed a majority of the audience. Let’s start giving them a bright side.

Robert: You know, they’re getting the experience that they want. They can understand their career path, their, their own futures with this company. But then also as the employer side, they’re not going to lose talent right away.

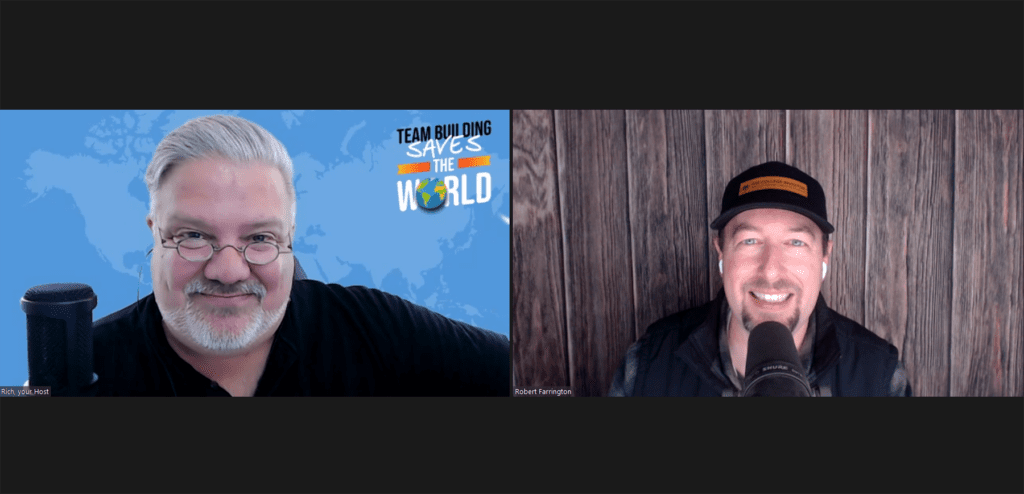

Rich: Hello team. It’s me, your old friend, Rich Rinisland host of team building saves the world. The show where I speak to the leaders and innovators, the employee wellness and corporate culture and how it reflects in the world of today. And today we’re discussing the graduates of the pandemic with millennial money expert, Robert Farrington

Rich: but first I do need to share some love with my support as a team bonding. If your team is ready to experience teamwork through the power of play, the visit team bonding.com to learn more. Now team join me in welcoming the founder of the college investor. Mr. Robert Farrington. Hello Robert,

Robert: how you doing out there?

Robert: My

Rich: friend.

Robert: Great. Thanks so much for having me. Hey, thank you.

Rich: Just so you’re aware that is a small group of people. I keep trapped under my desk just to applaud you. That’s their only job. Ha. So Robert, let’s start off with, uh, telling my team out there, who you are and how it is you got into this very

Robert: field

Rich: of work.

Robert: Yeah, definitely. So my name is Robert Farrington and I’m the founder of the college investor. And like many of us, I unintentionally stumbled into becoming a personal finance expert. Honestly, I had always been passionate about my personal finances. I am a side hustler, so, you know, I worked full time. I enjoyed making money on the side, selling things on eBay, and I would take that money and invest it and build wealth.

Robert: And I had this glorious vision of teaching others how to do. But then we encountered a challenge and that challenge was student loan debt. I had my own student loan debt. My friends were like, Hey, that’s great that you want to invest, but I’m looking at this giant pile of debt and I need to do something with it.

Robert: And so, you know, over the last decade I have transformed my messaging and my philosophy to let’s figure out how we can help people get out of student loan debt. So you can start investing and building wealth earlier, which is a lot funner to talk about, but we got to cover those basics, right.

Rich: Indeed speaking of which the focus of today’s episode, we’re talking about the graduates of the pandemic.

Rich: Those, I say kids because I’m old, but those young people who just when their life was getting ready to start, which is what everybody thinks. When they think graduation from college, they’re hit by this unforeseen circumstance. What actually happened to those graduates with the, with the pandemic.

Robert: Yeah. I mean, it has been an incredibly challenging 24, you know, 30 months at this point in time because you know, the world has been all over the place, right.

Robert: Uh, prior to the pandemic, you know, everything was just cranking along and then March 20, 20 hit and the bottom dropped out. And, you know, I think we had this really crazy dichotomy where, you know, some companies kept trucking along, are experiencing massive. Um, other ones went into panic mode and struggling and struggling to survive.

Robert: And now here we are fast forward 24 months, and we’re seeing, you know, again, a job shortage, incredible growth, but it’s in various fields. And, you know, depending on who you are as a college graduate, I see, you know, just crazy job offers that we’re looking to hire you and like your shower, you with money come work for us.

Robert: Or you could be in another field that, you know, there’s not a lot of job offers, especially in the hospitality, travel industries, you know, various things that, you know, people are still struggling to get back to quote unquote, normal, whatever that’s going to look like. And so, you know, it’s been a very interesting time.

Robert: I also think there’s been a lot of challenges for these graduates, right? Like these. Green workers. They are, you know, many of them it’s going to be their first real job or, you know, but how do you onboard these people? How do you train them? And so, you know, I’ve seen and heard so many stories of workers that, you know, either they love it.

Robert: Cause like I get to work from home by pajamas and I’m doing this job and they’re paying me. Or, you know, it’s like, I don’t know what I’m supposed to do. There’s no training. Uh, you know, they just expect me to do all these things like, and I’m lost. And so it’s been a really interesting two years with so many different experiences that it’s very hard to quantify, but I think there’s challenges and opportunities across the board.

Rich: We’re talking about the fact that they went from the college experience of being in classes every day with their, with their peers. To automatically, you know, they’re like everybody else they’re on zoom trying to learn from a small box on their laptops or tablets, or what have you. Plus they lost jobs that they had at the time.

Rich: They lost internships. I mean, these kids have been really struggling in ways nobody has had to beforehand.

Robert: Yeah. I mean, or even like a virtual internship, like, what is that? So I’m going to a shadow, someone on zoom, like, you know, I think they lost a lot of these real world experiences because you know, as much as we’ve transitioned to virtual work and it’s become more of a norm, I see a lot of challenges in onboarding new employees, doing internships, things like that through zoom, some careers.

Robert: Or a lot more conducive to it. Let’s be honest if you’re programming, if you’re coding, you know, it was very more individual worker based anyways. And so coming into those fields, you know, it’s a lot easier transition, but if you want to go into sales, marketing, leadership, things like that, I mean, it really just requires you being by someone’s side and learning.

Robert: The skills. And I think they’re seen a lot of struggle with that. And I’ve seen both sides of this equation. Honestly, I’ve seen it from the recent graduates that are lost, but I’ve also heard the frustrations from the companies that are like, why are we seeing more turnover? How do we get these new products go in?

Robert: I can’t get these new things going. We’ve lost this magic we had in 2020. And it’s like, well, yeah, everyone knew. On day one in March, 2020, everyone knew what they were supposed to do. Right. You know, it’s the same thing you did the day before, but now if you’re trying to grow a company or launch new initiatives or onboard new people or whatever that is, it’s a challenge.

Robert: And you know, that face-to-face connection is incredibly important. I think.

Rich: So are we still considering these kids, millennials?

Robert: You know, it’s gen Z. So millennials now are probably on their second job. They’re in their late twenties. You know, they graduated college, they’ve done something for a few years and you know, they’re trying to grow their career prospects.

Robert: And look at starting a family and building a home and all that kind of stuff. They’re in their late twenties, all the way to the oldest millennials now are 40, right? And so it’s a huge generation and they got a lot of interesting things too. Cause they’ve encountered several road bumps along the way between the great financial crisis in 2007, 2008.

Robert: And you know what all that entailed and that was when they were graduating. So this generation that I’m talking about today, I think they’re kind of being called gen Z today. Um, and they’re the ones that are graduating today into their, you know, early twenties. And they’re still in college right now.

Rich: So let’s talk about some of those things that we, that we know that the kids are missing out on.

Rich: Like you said, soft skills, follow up on that. What exactly are we doing?

Robert: Well, I think, um, on the employer side, you know, we talk about this a lot. What are the two biggest things that we look for when we’re talking about onboarding new people? Right. And a lot of it comes down to communication skills and it comes down to problem solving skills.

Robert: And those are two of the biggest kind of soft skills that we’re looking for. When we bring on new people and if you are gen Z and you’ve been on zoom for your last year or two of college, you haven’t been able to work your coffee shop or real retail job in any meaningful way. You missed out on an internship.

Robert: You know, they’re coming to the table with some gaps in these skillsets, and then we’re trying to onboard them into a company. It might be in a weird spot, whether it’s virtual work or we’re only doing like one meeting a year where we’re social distance or who knows what it looks like and all these various companies.

Robert: Right. But you’re trying to onboard these people that already have gaps. And now you are trying to do a new onboarding process. Probably has gaps because it’s just very different and we’re not closing that skill set. And so I see, you know, higher turnover, you know, both on both sides, right? Employee employers are frustrated, but these gen Z ears are frustrated.

Robert: They’re not learning the job. They’re not getting the experiences that they’re looking for. They’re not building connections, mentorship, networking, like things you just get from the natural work environment. And so inevitably they’re going to start searching for other employment. So I’m also seeing gen Z.

Robert: Two years because the job market has been so hot. You know, people are skipping jobs now, like every three months, cause they’re not trying to find a fit. Yeah. But I wonder how much of that is systemic. Not necessarily because of that individual or employer or what not, but just because of what we’re facing right now at the end of this pandemic knock on wood.

Robert: Right.

Rich: Well, what kind of things are we facing? I mean, like you said, the great resignation is still occurring. We’ve been talking about. Through several episodes now of the podcast. So how are these kids fitting into that?

Robert: Well, that’s what it is. So it’s this great resignation, but it’s, it goes both ways, right?

Robert: So employers are looking for certain, still skill sets and they’re having a harder time finding them. But on the flip side, you know, employees are trying to find fit for themselves. Like, what does this look like? And they’re not getting the onboarding experience that might necessarily be conducive to that.

Robert: They’re not getting the on the job training. And so it goes all around. I mean, that’s where it’s so hard to decide what it is. It’s like we can say pay people more. Sure. We can say offer benefits, like student loan, repayment, assistance, or other programs. That’s wonderful. But if you’re not going to train them up and give them an onboarding experience

Robert: that’s going to get them into the role that they’re going to need. Both sides are going to be frustrated. And then, you know, someone’s going to start looking for another job or the employers and start looking for another employee and you’re going to see higher turnover and higher costs. And so again, it’s why I say it’s more systemic.

Robert: It’s not just one side or the other side. It kind of goes all around and shared. And we have to figure out how to navigate this path of how do we onboard people that follows, you know, Basic health and safety protocols, but also gives them an experience that will help allow them to be successful because we all know turnover is expensive.

Robert: We all know training’s expensive, but if you do it right, there’s a massive ROI on it because you can, you know, have these people want a career and you know, they’re going to deliver results for your organization.

Rich: Plus, as you were saying, because they have lost the valuable work skills in the workplace, the resumes are of a huge gap.

Rich: And they haven’t actually had those face-to-face meetings with these people who can help them as they’re, as they’re onboarding.

Robert: So absolutely. I mean, we’ve, we’ve gone to, uh, we face-to-face conversations. This is you and I are having the extent for a lot of people right now, but it’s very hard because we’re so used to text and chat and emails and messages, and you know, there’s no, uh, interpersonal relationship being built there and you don’t get to see the mannerisms, the smile, the.

Robert: Where’s this conversation going, what’s going to happen? How do you learn? And then, you know, you just don’t get the visuals of the training and, you know, trying to understand that. And that, that goes a long way, especially in a lot of the fields like sales and marketing. And like I said, leadership, you know, technology is great at enabling some fields and we’re seeing that and Silicon valley and tech in web three.

Robert: And however you want to define that, but you know, in a lot of other skills, you really need that face. Side-by-side onboarding and training experience so that you can have successful results from both parties.

Rich: Alright Robert, if you don’t mind, hold on one second for me, I do need to step away for a quick second, and I want to tell all my team out there about a company I’m very proud to be a part of team bonding.

Rich: Team bonding was founded over 20 years ago with one simple question. How can employees have a great time while fostering strong, authentic bonds between people who worked. They’ve created a catalog of innovative events using the power of play as a learning tool and tapping into the correlation between work and play from scavenger hunt to jeopardy and so much more the team bonding of activities, whether live virtual or hybrid maximizes the impact of team building with an accent on fun.

Rich: So visit team bonding.com to schedule your event. Team bonding when you want seriously fun results. And I’m back with Robert Farrington talking about the recent graduates of the pandemic. Okay. Here’s the thing that’s throwing me for years now, even before the pandemic, I have been hearing about kids graduating after their parents have spent and they to be fair have spent thousands upon thousands of dollars and an education to find out they’ve got to go back and live with mom and dad again, because there’s nothing for them or they can find a job, but it’s not the career they’ve been training for. How is that different from what these graduates are facing now?

Robert: You know, it’s just getting compounded more and more. So, uh, you know, we have this two loan debt crisis, which, you know, our media likes to sensationalize the extreme.

Robert: So I, I think it’s important. Let’s talk about the student loan debt crisis and just give some framework for it. So, you know, right now, 30 million or 41st, sorry, 40 million Americans have student loans. So it’s about a third of our working class ages, you know, have student loans. And the average student loan balance is roughly $39,000.

Robert: Okay. But that’s not the balance at graduation, the balance at graduations in the low thirties. And so you can see. Um, and so this has been growing and growing steadily over the last decade, and it’s really starting to get hyperbolic. And that’s the problem, right? Anyone that knows and is looked at a chart of compound interest, knows that every time it grows, it gets really more and more hyperbolic.

Robert: And that’s the problem we’re facing, right? Because student loan debt has been around for 40 years at this point in time. And it wasn’t a problem before. Right. But that’s because the debt levels were so much. And when people graduated, the wages that they had allowed them to service this debt and provide for their families.

Robert: And so the problem is, is we’re coming to this tipping point of growing levels of student loan debt with diminishing wage growth and ROI and inflation of living expenses. And so, you know, when you’re looking at a household budget, you know, these categories. Living expenses and servicing your student loans have grown, you know, exponentially over the last 10, 20 years on an individual level.

Robert: But at the same time, we know statistically that wage growth hasn’t kept up as a result. People are feeling squeezed and yes, it is a minority of Americans. It’s a third, that’s a lot of working Americans, but it’s not a majority. But when you’re talking to gen Z and millennials, it is a much larger part of that population.

Robert: And so that is when you know, they’re looking at their options and they’re seeing that like, man, I have to pay for my student loans and pay for my education, but my wage or my income isn’t necessarily gonna, you know, be enough for me to live. Especially when you’re looking at high cost of living areas.

Robert: So the coasts, right, or even Texas, these days, you know, across the living skyrocketing. And so they’re just really stressed and there’s a financial burden to that. And so, you know, companies are looking at how to adapt to this. They’re offering student loan, repayment, benefits, they’re offering, you know, a lot of different programs and incentive.

Robert: But at the end of the day, there’s this giant financial stressor and, you know, companies are going to have to adapt their models to that, whether it is remote work and letting people live in lower cost of living areas, whether that is student loan, repayment assistance, whether that’s higher wages, you know, there’s a lot of different levels.

Robert: You know, we can pull and then we have to talk about, you know, the political impact, you know, there’s different ways that we can reform the system. But, you know, the fact is there’s also a high school student today, as we’re recording this, that’s applying for college and, you know, we can talk about loan, forgiveness, and not yada yada yada.

Robert: There is a person today that is like, Hey, I want to go to college. The statistics still show that college degrees earn more over their lifetime than non-college degrees. Right. We can’t dismiss it. There is value in college, but the question is, is. And so, you know, there’s all different numbers today, but it says, you know, it used to be a million dollars.

Robert: If you went to college, had a bachelor’s degree, you would earn a million dollars more over your lifetime than non-college graduates. However, a recent study today, uh, that just came out a couple of weeks ago by a non-profit says that’s down to about 400 to $600,000, depending on your major and your gender.

Robert: Right. We can’t dismiss that that’s still a good amount of money, but now the present value of that isn’t the same, right? So like, should you spend a hundred thousand dollars in today’s dollars to earn $500,000 over the next 40 years of your life? Right. That’s a much more challenging financial situation.

Robert: And so that’s what these young adults are facing today. Not necessarily getting any better. It’s just getting more complex. And you know, the math and the dynamics are getting more challenging because you know, people do enjoy living in the coast and they do want a certain level of living, but, and it’s still where all the best jobs are.

Robert: And it’s still where all the best jobs are. Right. Because that’s why it is what it is. But on the flip side, if you’re servicing a large mass you loan debt, and then looking at housing prices and maybe wanting to start a family and. All these other factors, it becomes a very complex, you know, psychological problem and math problem, all combined.

Rich: All right. So we have just depressed a majority of the audience who hopefully are listening and thinking to themselves, everything you’re saying is I have something that I am in right now, or that I’m heading into. Let’s start giving them a bright side. How can we fix it? I mean, you have created a company in millennial, personal finance, literally to help people do this.

Robert: So where can we say exactly? So it sounds crazy, but we have to start by getting organized. And like, I know it’s not a very sexy thing to say, but

Rich: you just lost my 16 year old daughter right there,

Robert: but that’s it. We can’t have a good conversation about what you value with unless we know where everything lie.

Robert: So I like to just write it all down. I’m not here to budget and tell you, you can’t go buy your $5 coffee. I’m not that guy. No coffee, and you can afford your student loans and your lifestyle. Now let’s lay it all out there on the table and be honest with ourselves what’s coming in, or what do we hope is going to come in?

Robert: What’s going out? What do we own and what do we owe? But the second half of this equation that we rarely talk about is what do we value? As people and where are we spending our time? Like, let’s break out the calendar and list our 168 hours a week and see where we’re spending our time, because you know, our money, the money is math, right?

Robert: I mean, it’s what we learned in first grade, you know, 100 plus 100 is two that’s easy. Like that doesn’t matter. The reason you’re struggling or dealing with your money is because. Your values and your time, and that’s where it all comes down to. So what do you value, do you like to travel? Do you value living in an urban area above restaurants and bars?

Robert: Do you like going to friends and family, or do you like to like work? Is that your value set? Right? Do you like to go to meetings and have that? Like, what do you value as a person? And then we need to look at your time because I also would say that, you know, when you’re young. And this is generalizing. You typically have more time in your day.

Robert: You don’t have kids and a family and other commitments outside of it. So you also have a lot of potential to maybe do something else with your day. So whether you’re working and then maybe you do something in the evenings, you side hustle, you can earn more, or maybe, you know, you’re going to spend that time, you know, preparing your own meals and saving money.

Robert: Like there’s just different things. But if you have your value set and you have your calendar, Um, we can then look at your budget and start pulling a lot of different levers to decide on what’s right for you. Maybe you just do not want to cut spending. It’s not your jam. You enjoy going out with your friends four nights a week, but.

Robert: You are very entrepreneurial. Maybe you spend your extra time in your day going out inside hustling, you know, doing gig work outside of your main job to add a couple of hundred bucks a month to your budget so that you can achieve your goals without cutting. Maybe that’s not your jam. Maybe you’re like, I do not want to do any of that.

Robert: I want to stay home, but I can read, and I don’t need to watch Netflix and I can cook my own meals. But again, it goes back to your. Uh, and what’s important to you. And I don’t want to tell you what’s right or wrong, but we really have a value and a time conversation that can get you to your end goal.

Rich: As I was saying to you, I have a daughter who’s 16.

Rich: She’s only just started to sophomore. She’s just started getting it all the college letters. Now come see us. We’d love to meet you. What can I start doing?

Robert: You know, it’s being one transparent on what we have to pay for school and what that’s going to look like for our family. Now you don’t need to give her a full net worth breakdown and say like, here’s my whole budget, but like, Hey, you know, we’ve saved this for college.

Robert: Or honestly, we haven’t saved much for college or whatever that looks like. I would also say like, where do you think you want to go? What do you want to do? Right. Because that’s going to play a big role in it. And I think, you know, having conversations with people that are, whether it’s family or friends, That are doing different things, I think is huge.

Robert: And what I mean by that is maybe you have someone that’s got that corporate job and they went to school, but ask them, haven’t met, just had those random conversations, like, Hey, did you actually, you know, use your major? Are you doing the same thing these days or was that private school really worth it?

Robert: Or is it a state school? Like would have been just fine for what you’re doing? You know, also exposing our young. And, you know, high schoolers to non-traditional jobs of people that are successful. For example, my father-in-law was a lineman for our power company, but like, you would have never known this, but I mean, he was making $200,000 a year, you know, and just taking the bucket truck down and doing those things.

Robert: Like you don’t realize that there are successful. Non-college. As well, right. We don’t necessarily expose our kids. Every, every kid today sees Elon Musk and Jeff Bezos. And they’re like, I want to go to TAC and I want Silicon valley and I want this. And it’s like, you know, there’s a lot of like really mightily successful people that don’t do those things.

Robert: Right.

Rich: It is so expensive. There. Everything is so expensive.

Robert: Absolutely. So exposing them to different things that they might not have seen, whether that’s through volunteer, work conversations with family and friends, job shadows right along. I thought I wanted to be a doctor for a long time. And the best thing my dad ever did was say, you need to go be a candy striper and volunteer in the hospital.

Robert: And so I did that one. I got my volunteer credits for college applications, but two. I do not like being in the hospital and working and like, I can respect what they do. This is not the career field for me, but job shadowing and getting those exposure huge. Um, and then finally, you know, having a real conversation about ROI.

Robert: Return on investment. And you know, it’s hard because the college conversation is so personal to a lot of people. Everyone should go to college or you should go to this school because I went there, who knows, but you know, we’d have a Frank conversation. I don’t want to turn down any kid’s dream, but if you want to be a teacher, phenomenal career choice, but you know what, the average starting teacher salary in America is like $45,000 a year.

Robert: Right. Okay. So you shouldn’t spend more than that to become a teacher or else you’re going to struggle. When you’re a teacher and you’re not going to enjoy your job because like you have that financial burden, everything we just talked about, but there are valid paths to get there without spending that money.

Robert: Maybe it’s going to community college for two years, knocking out all those general credits and you know, in about 30 states right now, community colleges free. So you can get there for free and then you transfer, get your credential for two years. Maybe you spend 10,000 bucks and now you could be a teacher now, and you’re making a $45,000 a year entry job, but you only have $10,000 in student loan debt.

Robert: You’re going to feel really good and enjoy your career choice so much more because you’re not going to be burdened so much by the path you took to get there.

Rich: Now let’s look at it, talking about the workforce. We had started talking about the possibility of, of how employers, how corporations can actually help with onboarding.

Rich: Let’s dig deeper into that. What is it that a corporation should really start looking at now to make sure that they’re finding the best candidates for their position?

Robert: Yeah, honestly, they need to look at, you know, beyond the wages, we all know it, pay people more sure. But also the benefits whether that’s student loan, repayment assistance, or some variation on that, but also things like health benefits, huge, right?

Robert: Like, I mean, some of these marketplace plans or other things can be very costly, especially to a young adult that’s healthy. And it was like basically paying for bankruptcy insurance that they’re never gonna use. But then also it’s that onboarding and training experience. So, you know, as much as we want to stay virtual and maybe avoid the office, like, I think there’s a lot of employers that one, a lot of them are already doing it, but like, you need to, especially the more corporate, you know, fortune 500 companies need to say like, Hey, we’d onboard, bring people into the office, set up mentorships, networking, and train these people the right way side-by-side with experienced.

Robert: So that. You know, they’re getting the experience that they want. They can understand their career path, their, their own futures with this company. But then also as the employer side, they’re not going to lose talent right away to people that aren’t trained or as a manager being frustrated, like why doesn’t this person get it?

Robert: Well, did you ever show him, you know, we’ve got to teach him how to do the jobs. And so these companies need to set up their onboarding so that they’re bringing. Younger a, you know, more green, you know, graduates into the fold in a way that’s going to set them up for success for not just the short term, but also hopefully for the medium and long-term as well.

Rich: What are the graduates need to know for themselves to help in that?

Robert: I think the hard part is, is that they need to realize that, you know, not every job can be virtual from day one. Right. And I think that’s been an interesting conversation because you know, we’re in this day and age where you can go on indeed and just search for virtual only jobs.

Robert: And these college graduates are like, well, I’m just gonna work from home on my pajamas as I’ve been doing college this way for two years, and now I can work and I can get a great salary, but. Yes, you could, but you don’t necessarily have the skillset or experience to be successful at that yet. And you know, we need to have those conversations with these young adults that says like, Hey, you know, there’s a lot of value in getting some real hands-on experience, some training and know how to do your job, to set yourself up for success.

Robert: So then you could open more doors for yourself in the short term and in the long run with maybe virtual, maybe not, but at least you’ll know what you’re expected to do on your job. Yeah. You won’t be as frustrated as well with what your expectations are.

Rich: Are there ways that exist right now that this year’s graduates can look to,

Robert: to help them?

Robert: I mean, honestly, we’re already seeing that. I mean, as we’re recording this again, knock on wood, you know, we’re, we’re turning the corner and a lot of restrictions and we see more and more companies that are opening up and getting back to more normalized training programs. But I think that that’s going to be the key, but I think some of these companies.

Robert: Yeah. You know, especially these tech ones are like, we’re going to be a hundred percent remote, a hundred percent remote. And so when I’m, you know, a college senior, and I’m seeing that, that could be appealing to me, but they also might be a disconnected expectations of like, well, what do you mean that I have to go to do this thing or go to this, you know, job center or whatnot.

Robert: And so I think these companies need to make sure they’re level setting those expectations, especially with new graduate. Whether it’s in their internship program. I know a lot of the fortune 500 companies, you know, they set up very strategic internship programs, so that can pull a pool of workers in, but some of those were virtual now, as they’re moving them back into in-person, you know, internships, but Hey, you’re going to have still training and we’re going to be in person and you’re going to do this.

Robert: There might be some virtual, some hybrid. But they need to really make sure that they’re level setting those expectations of in-person training. Of course, there could be some hybrid stuff, but you know, you’re going to get better results with in-person onboarding and training. Okay.

Rich: Robert, do you have any piece of advice?

Rich: Like one good thing to focus on for that recent or soon to be graduate to, to let them know how they can start the ground.

Robert: Yeah, honestly, is I think it’s learning and networking as much as possible. Put yourself out there to be as valuable resource as you can, and realize that, you know, you need to learn this and so that you can deliver results.

Robert: Like I think some of these younger adults go into the situation with what are you doing for me? What are you doing for me? How is this going to help myself? And it’s a mindset shift, just like, what can I do for you? How can I learn this? What can I do better? And that’s where I start to see the inflection point.

Robert: I shared this with a lot of young adults, but it’s like, what’s the differentiator of that recent grad at the 18 month mark of their first job, how come some just jump and other ones get stuck in this plateau at the lower level. And a lot of that comes back to. What are they doing for the company? What are they trying to learn?

Robert: How they’re trying to better themselves? What are they doing? And I think the best thing you can do as a new graduate today is go into it with a learning mindset, growth mindset, like just like you did in college. It doesn’t change. Do that for another couple of years, learn, learn, learn, adapt, and you’ll see more success is faster than people that don’t do that

Rich: because facing so many new challenges that who knows if college is even prepared. Not the least of which being the fact that they’re going to be dealing with people who are my age and. Who literally don’t speak the same language they do. It seems like most times,

Robert: so it’s challenging, but that’s, it is. I think if you go into it with like, I want to learn, I want to grow. I want to understand you’ll get so much farther ahead beyond the empathy you’re going to get.

Robert: You’re also going to just understand and learn more other ways. Right. But if you go into it with like, well, I only text you know, or whatever it happens to be, you know, it’s not necessarily going to propel you ahead in your career growth, at least at the beginning.

Rich: Robert, thank you so much for coming on board.

Rich: This has been a great conversation. And like you said, this is a topic where, when my producers brought it across. I was like, oh, I hadn’t even thought that this was something we should be discussing, but yeah, this we’re talking about a majority of the up and coming workforce and that they have so much to learn as well as the workforce itself, needing to learn how to deal with these people. So,

Robert: yeah, it goes both ways around and every business is transforming the way they’re operating these days. Right. And so they need to be mindful of, you know, it’s hard because it’s your short-term and long-term like, how do we, I need to hire a position now, but I also need to onboard this person. Right.

Robert: Okay. They’re coming at it from a very different mindset than someone that’s been doing the job for 20 years. And they’re like, yeah, I can do this on zoom all day. It doesn’t matter. I know exactly what I’m doing. I’ve been doing this forever where you can’t necessarily say that to a 19 or 22 year old or whatever it happens to be.

Robert: That’s like, uh, you know, last month I was taking English and today you want me to like put together this presentation? Like, I don’t really know what I’m supposed to do here. Right?

Rich: Tell me, tell my team rather, where can they find you or where can they find resources?

Robert: Absolutely. So you can find me@thecollegeinvestor.com, where we talk about everything, about getting out of student loan debt to investing.

Robert: We also have a podcast and a YouTube channel. So however you like to consume your content, you can find us there under the same name, the college investor.

Rich: So your podcast and to also the college.

Robert: You got it.

Rich: Fantastic. I’m going to look you up and hopefully you will pass me along to your teams as well, but absolutely

Robert: because that’s what podcasters

Rich: do.

Rich: Uh, Robert, thank you again. I hope you’ve enjoyed being here as much as I’ve enjoyed having you.

Robert: Well, this has been great conversation. I think it’s super valuable.

Rich: Thank you. Thank you. And I hope you continue to feel that. Because as we discussed in the pre-interview it’s time for MySpeed

Robert: rounds,

Rich: I don’t know if your podcast has this level of cheese.

Rich: All right, Robert, here’s how this is going to work. This is just. See, I designed this entire thing because originally I was talking to people in just the team building industry itself, where, when people would get together and learn how to work better together, usually we would be faced with a lot of rolling eyes and people saying, oh no, it’s another one of these

Robert: things.

Robert: So icebreaker. Oh yeah, exactly.

Rich: So what this is, is this the 60 seconds where I’m going to ask you a bunch of very silly innocuous. You answer them as fast as you can. I don’t know how competitive you feel, but for season three, we’re looking to be 10. Oh, wow. Okay. So like I said, the music is going to start, I’ll start asking questions and away we go.

Rich: Let’s do this, right? My friend. What’s your name?

Robert: Robert Farrington.

Rich: Do you have any children?

Robert: Yes. Two children.

Rich: Which one’s your favorite?

Robert: Oh, they’re the same one. Both.

Rich: Would you rather win an Olympic medal? The academy award or the Nobel peace prize?

Robert: Oh, I think an Olympic medal.

Rich: What do you think the greatest invention of all time is?

Robert: Oh man. Uh, I think it is the internet. Come on. We’re here right now.

Rich: What’s your favorite smell in the world?

Robert: , fresh baked chocolate chip cookies.

Rich: If you could choose a nickname for yourself, what would it be?

Robert: Uh, Robbie,

Rich: what is your favorite time of day?

Robert: Oh, that little bit right before sunset when it’s still light out, but it’s got that cool, like look in the sky.

Robert: Nice. If you could ask the president one question, what would it be? Why.

Rich: Any other name than Robbie? What would it be?

Robert: Oh, I don’t know. Oh man. Now you hit me. Stop me on the last, well,

Rich: we’re going to give you a nine Robert nine ride.

Rich: All right.

Rich: Congratulations to you. And thank you again for coming on board.

Rich: You have been amazing and I’ve, I’ve actually really enjoyed this whole topic. Thank you.

Rich: Awesome. Thank you very much. This has been so much fun. Thank you, sir. And thank

Rich: you to all my team out there that. We wrap up yet. Another episode of team building saves the world. If you’ve enjoyed this episode, whether you’re new to the podcast, an old fan of the show, please be sure to share this podcast with everyone.

Rich: You know, whether they’re a coworker friend, family, what have you, it’ll help us to share all of this vital information. You can find out all about us, including all past episodes. Of the podcast@teambonding.com forward slash podcast. You can also find us wherever you find your favorite podcasts, Google podcasts, apple podcasts,

Rich: Spotify.

Rich: What have you, where have you listened? That’s where

Rich: we’ll be. Don’t forget to look us up on all the social media is at team bond podcast. Leave us a message telling me whether you liked the show, or if you have any ideas for future topics or questions about a topic you’ve already met. We want to hear from you.

Rich: And if you leave a comment, I may even mention it on a future episode. If I liked what I read, but before we start. Well, this episode of team building saves the world. Never forget that if you’re within the sound of my voice, you are on my team now. And I am forever going to be on yours. Take care team, and I’ll see you next time.

Rich: It’s been said that you learn more about a person in an hour of play than in a year of conversation. So why not put your coworkers to play with the help of the team at team bonding team bonding was founded over 20 years ago with one simple question. How can employees have a great time? Fostering strong, authentic bonds between people who work together.

Rich: Their catalog of innovative events include scavenger hunt, jeopardy, and much more. Each activity whether live virtual or hybrid, maximizes the impact of team building with an accent on fun. Visit team bonding.com to schedule your event now, team bonding. When you want seriously fun results.

March 29, 2022

Every generation graduates with challenges, however, our most recent graduates face a particularly unique set of hurdles as they enter the workforce.

In this episode, Rich talks with Robert Farrington from The College Investor, about new graduates entering the workforce. During the pandemic, almost everything switched to remote or virtual remote work overnight. For those new graduates entering the workforce companies had to change some well-established onboarding and training.

Robert Farrington, the founder of The College Investor, has been featured in many media outlets on both a local and national level. He is America’s Millennial Money Expert®, and America’s Student Loan Debt Expert. He is on a mission to help people escape student loan debt and start investing and building wealth for the future.

From onboarding, to companies looking at some benefits to offer, listen as Robert Farrington talks about some of the ways to support recent graduates.

" “We have to figure out how to navigate this path of how we do onboard people that follows, you know, Basic health and safety protocols, but also gives them an experience that will help allow them to be successful because we all know turnover is expensive.”"- Robert Farrington

Get more human resources and leadership advice.

Less drama? Greater teamwork and job satisfaction? TeamBonding is here to help you build a stronger and happier team. Subscribe to get our team building podcast and thought leadership blogs sent straight to your inbox.